BLUF: In Northern Virginia, new GovCon firms don’t lose because they can’t deliver—they lose because evaluators can’t quickly see proof. From day one, build a mission-focused website (not a cookie-cutter GoDaddy/Wix template), spin up micro-niche landing pages for each target agency, and pair them with sharp, 508-ready capability docs optimized for AEO so contracting officers and primes find you, trust you, and act. Do this and your top-10 startup hurdles—registrations, past performance, CMMC, pricing, vehicles, proposals, pipeline, cash flow, talent, and differentiation—become a process, not a brick wall.

Northern Virginia GovCon Startups: Top 10 Challenges & the Digital Playbook

Introduction

Launching a federal contracting venture in a competitive hub like Northern Virginia can feel daunting.

This region is saturated with defense and government contractors everyone claims to be “mission-focused” and to have past performance.

To stand out and succeed, new contractors must address common hurdles early on while establishing a strong digital footprint from the outset.

Below we explore the top 10 challenges new federal/defense contractors encounter and fast, practical ways to handle each.

Implementing these solutions – from compliance registrations to a mission-focused website – will help a young GovCon firm become visible, credible, and ready to win.

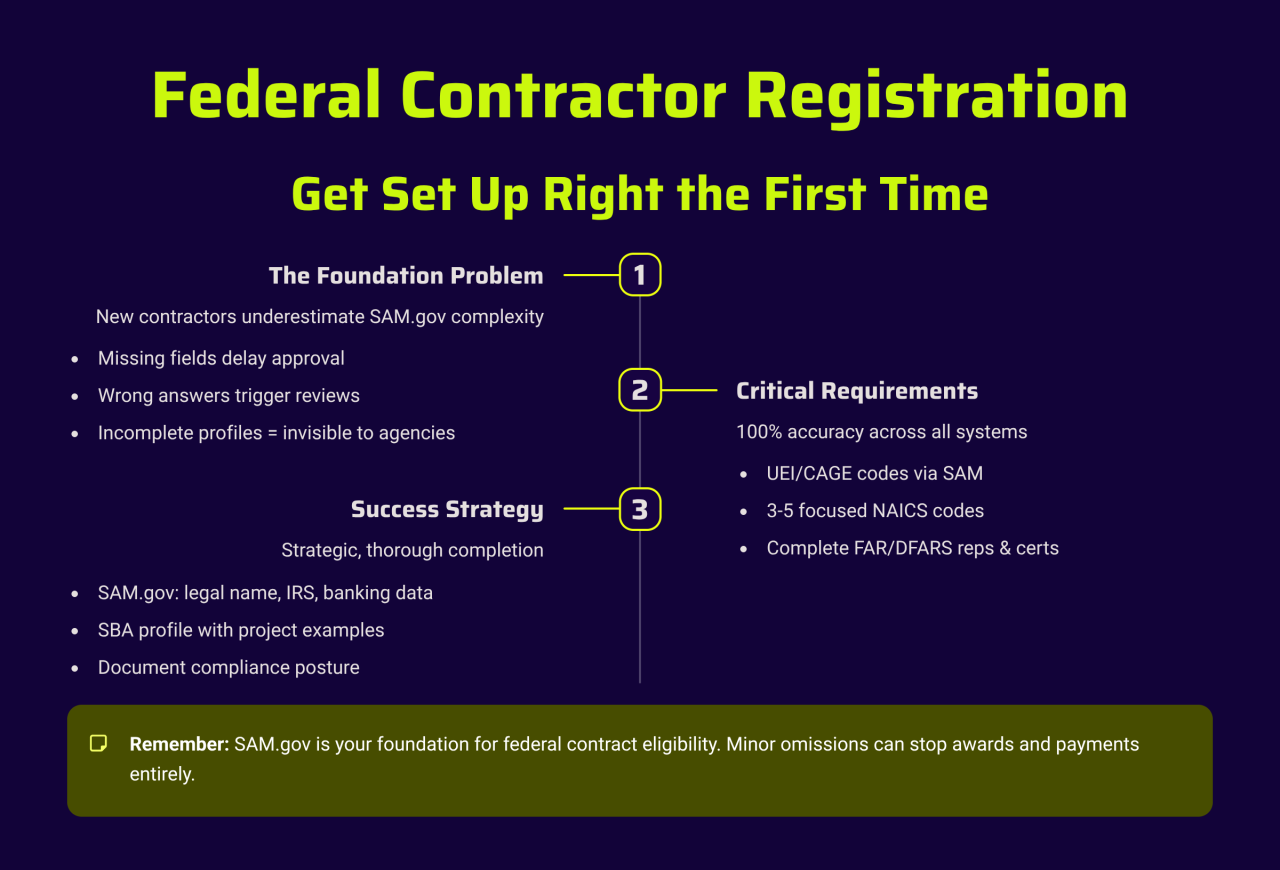

1. Registrations & Compliance Setup

Problem: Confusion around mandatory registrations (UEI/CAGE codes, SAM.gov), choosing NAICS codes, completing SBA profiles, and filling out FAR/DFARS representations & certifications.

New contractors often underestimate how complex SAM registration is missing a single field or answering a reps & certs question incorrectly can derail or delay approval.

For example, SAM.gov is “the foundation of your eligibility to win federal contracts” and an incomplete profile can mean you “may not even show up in contractor searches.”

Mistakes like requesting a UEI without finishing full registration or mismatching business info can trigger manual reviews and weeks of delay.

Solution: Complete all registrations thoroughly and strategically.

Set up your SAM.gov entity profile with 100% accuracy and completeness (legal name, IRS info, bank data, etc.) it’s not just a formality but the basis for getting paid and being found by agencies.

Select 3–5 NAICS codes that genuinely fit your capabilities (don’t list dozens you can’t perform – focus where you can win).

In SAM, carefully fill out all Reps & Certs (ensure you answer each FAR/DFARS question correctly to avoid compliance flags).

Likewise, complete your SBA profile (Dynamic Small Business Search) with past project examples and keywords so primes and agencies can discover you.

Obtain your CAGE code via SAM (it will be assigned upon activation).

To keep yourself organized, document your compliance posture in a one-page “GovCon readiness” memo list your registrations, small-business certifications, and key compliance steps taken (like affirming FAR ethical standards) for quick reference.

In short, get registered properly from the start, because even minor omissions in SAM.gov can stop you from getting awards or payments.

2. “No Past Performance” Barrier

Problem: It’s hard to win contracts without relevant past performance in the federal space. Agencies heavily weigh past performance (CPARS ratings or references) to gauge risk, so a brand-new contractor with no government record often appears less credible. Technically, the FAR requires giving new offerors a neutral rating for lack of past performance, but in reality a proposal with zero similar projects can struggle against incumbents. This creates a Catch-22: you need contracts to get past performance, but need past performance to win contracts. Many small businesses cite this as a major obstacle.

Solution: Leverage partnerships and relatable experience to build your past performance.

If you lack direct federal contracts, start by subcontracting under established primes or joining teams on IDIQ vehicle contracts.

For instance, partnering with more experienced firms via subcontracts, joint ventures, or mentor-protégé agreements can “strengthen your credibility” as a newcomer.

Delivering a few small tasks successfully as a sub gives you performance stories and possibly ratings.

Also, map your commercial work to government needs – many agencies will consider relevant private-sector projects when evaluating you.

In your proposals and capability statements, translate your commercial project outcomes into terms of government objectives (e.g. meeting a Performance Work Statement requirement).

Collect releasable case studies or reference letters from those non-federal projects; sanitize any sensitive data and highlight the results achieved. Over time, you can publish these success stories on your website or marketing materials as proof of performance.

Additionally, take advantage of programs like the SBA mentor-protégé or small business set-asides to get “foot in the door” contracts.

The key is to “borrow” credibility until you build your own – use the past performance of partners and the echo of your commercial successes to overcome the initial barrier.

Every pilot project or subcontract completed is one more reference to help convince agencies you can deliver.

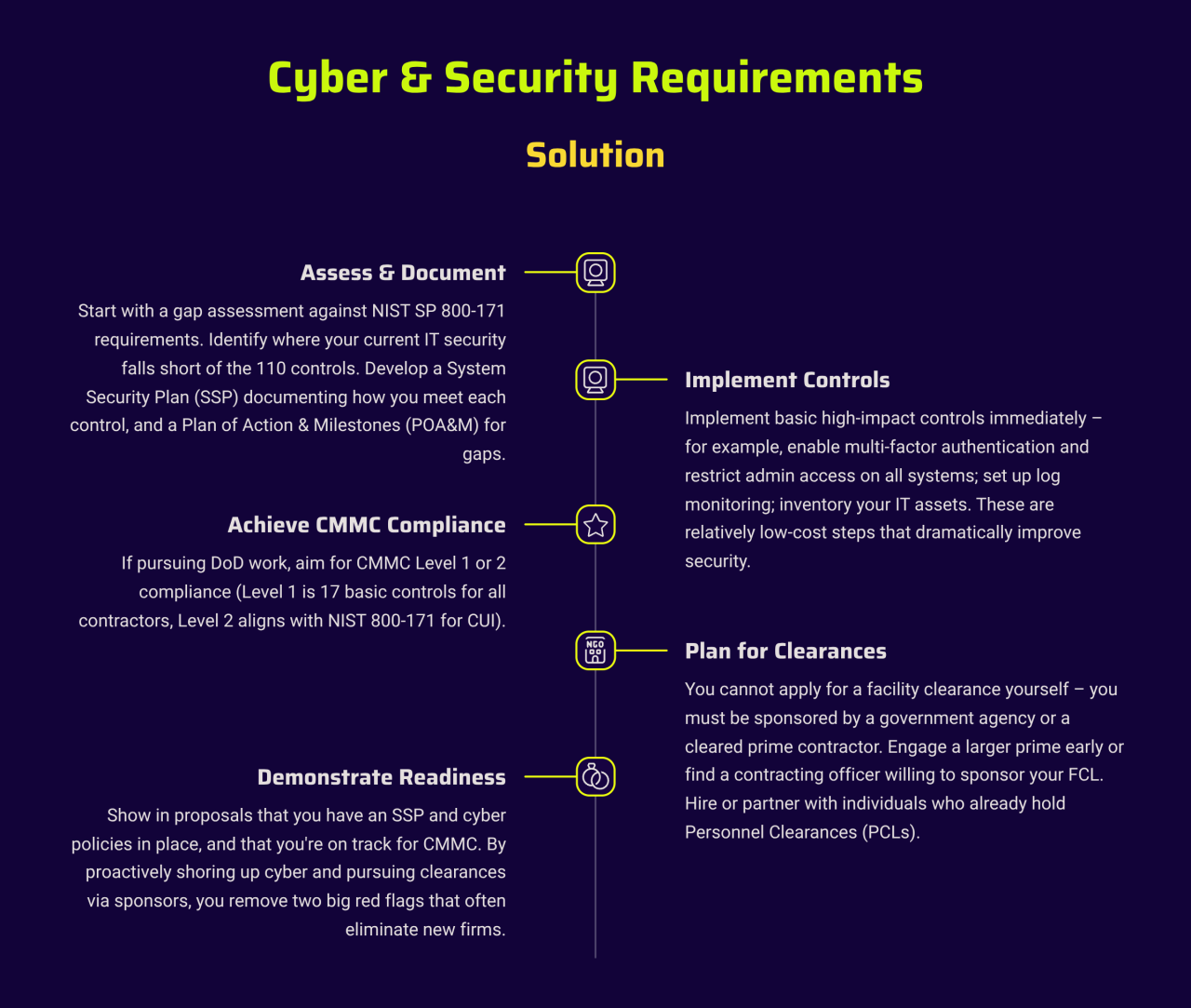

3. Cyber & Security Requirements

Problem: Navigating cybersecurity and security clearance requirements is a major challenge for new defense contractors.

Many contracts involve Controlled Unclassified Information (CUI) or even classified work, triggering rules like NIST SP 800-171 (110 security controls for CUI) and the DoD’s CMMC (Cybersecurity Maturity Model Certification) program.

Small firms must implement baseline cybersecurity safeguards (e.g. multifactor logins, incident response plans) to handle CUI – failing to do so can disqualify you from DoD contracts.

Additionally, pursuing classified contracts requires a Facility Clearance (FCL), which you cannot obtain on your own without a sponsor.

Hiring cleared personnel (PCLs) is tough if you don’t already have an FCL or pipeline of cleared candidates.

In short, compliance with NIST/CMMC standards and industrial security rules (FAR 52.204-21, DFARS 252.204-7012, etc.) is burdensome for small businesses and often confusing.

Solution: Get a cybersecurity house in order and plan for clearances early.

Start with a gap assessment against NIST SP 800-171 requirements.

Identify where your current IT security falls short of the 110 controls (e.g. do you have access controls, logging, incident response plan?).

Develop a System Security Plan (SSP) documenting how you meet each control, and a Plan of Action & Milestones (POA&M) for gaps.

Many small contractors struggle here, but note: those without an SSP/POA&M risk being disqualified from awards. Implement basic high-impact controls immediately – for example, enable multi-factor authentication and restrict admin access on all systems; set up log monitoring; inventory your IT assets.

These are relatively low-cost steps that dramatically improve security.

If pursuing DoD work, aim for CMMC Level 1 or 2 compliance (Level 1 is 17 basic controls for all contractors, Level 2 aligns with NIST 800-171 for CUI).

Meanwhile, plan for clearances if needed: you cannot apply for a facility clearance yourself – you must be sponsored by a government agency or a cleared prime contractor to get an FCL.

So, if a contract will require secret clearances, engage a larger prime early or find a contracting officer willing to sponsor your FCL as a condition of award.

In the interim, hire or partner with individuals who already hold the needed Personnel Clearances (PCLs) at least at the interim level.

Bottom line: demonstrate a “security first” posture as part of your readiness.

Show in proposals that you have an SSP and cyber policies in place, and that you’re on track for CMMC.

By proactively shoring up cyber and pursuing clearances via sponsors, you remove two big red flags that often eliminate new firms.

4. GovCon Accounting & Pricing

Problem: Federal contracting requires a meticulous accounting system and disciplined pricing approach – areas where new firms often stumble.

The government (especially DCAA for DoD contracts) expects contractors to have a “job-cost” accounting system that can segregate direct vs. indirect costs, track costs by contract, manage timekeeping, and exclude unallowables.

Many small businesses initially use basic bookkeeping that isn’t adequate for cost-reimbursement contracts or DCAA audits.

For example, you must be able to identify costs by contract line item (CLIN) and roll them up under General Ledger control.

You also need proper labor timekeeping and labor distribution controls (no charging direct time to indirect accounts, etc.).

In pricing proposals, newcomers may struggle to set indirect rates (overhead, G&A) and may not realize certain expenses (like lobbying or alcohol) are unallowable by FAR 31 and must be excluded.

Without these systems and policies, a contractor can be deemed “not responsible” for certain awards. In short, inadequate accounting practices and naive pricing (overbidding or underbidding) are common pitfalls.

Solution: Stand up a DCAA-compliant accounting framework and price methodically.

Even as a very small business, institute job cost accounting from the start.

Use software or systems that can segregate direct vs. indirect costs and accumulate costs by contract (each contract is its own “job” in your ledger). Implement a timekeeping system where employees record hours daily and charge to the correct contract or overhead code – timesheets are critical for labor audits.

Set up your chart of accounts to flag unallowable costs (meals, certain travel, etc.) so they are recorded separately and excluded from any billing to the government.

Develop written policies for timekeeping, expense approvals, and billing; DCAA will want to see you have internal controls documented.

Next, establish provisional indirect rates (e.g. an overhead % and G&A %) based on your anticipated costs, and apply them consistently in pricing.

When bidding, present a clear Basis of Estimate (BOE) for all cost elements – show how you derived labor hours, rates, material costs, etc., to justify that your price is reasonable.

Ensure your price volume also maps costs to the CLIN structure of the RFP (e.g. if the solicitation has separate CLINs for labor vs. travel, your pricing must be broken out accordingly).

This traceability will give evaluators confidence in your numbers.

If you’re unsure, consult resources like the DCAA SF 1408 checklist, which outlines accounting system adequacy criteria (segregation of costs, interim billing, etc.).

In summary, treat accounting and pricing as compliance disciplines: invest early in a proper system (even QuickBooks can be configured for job costing with help, or choose a specialized GovCon accounting software), and price every proposal with a detailed, transparent cost build-up.

This avoids audit problems later and signals to the government that you are financially sound and responsible.

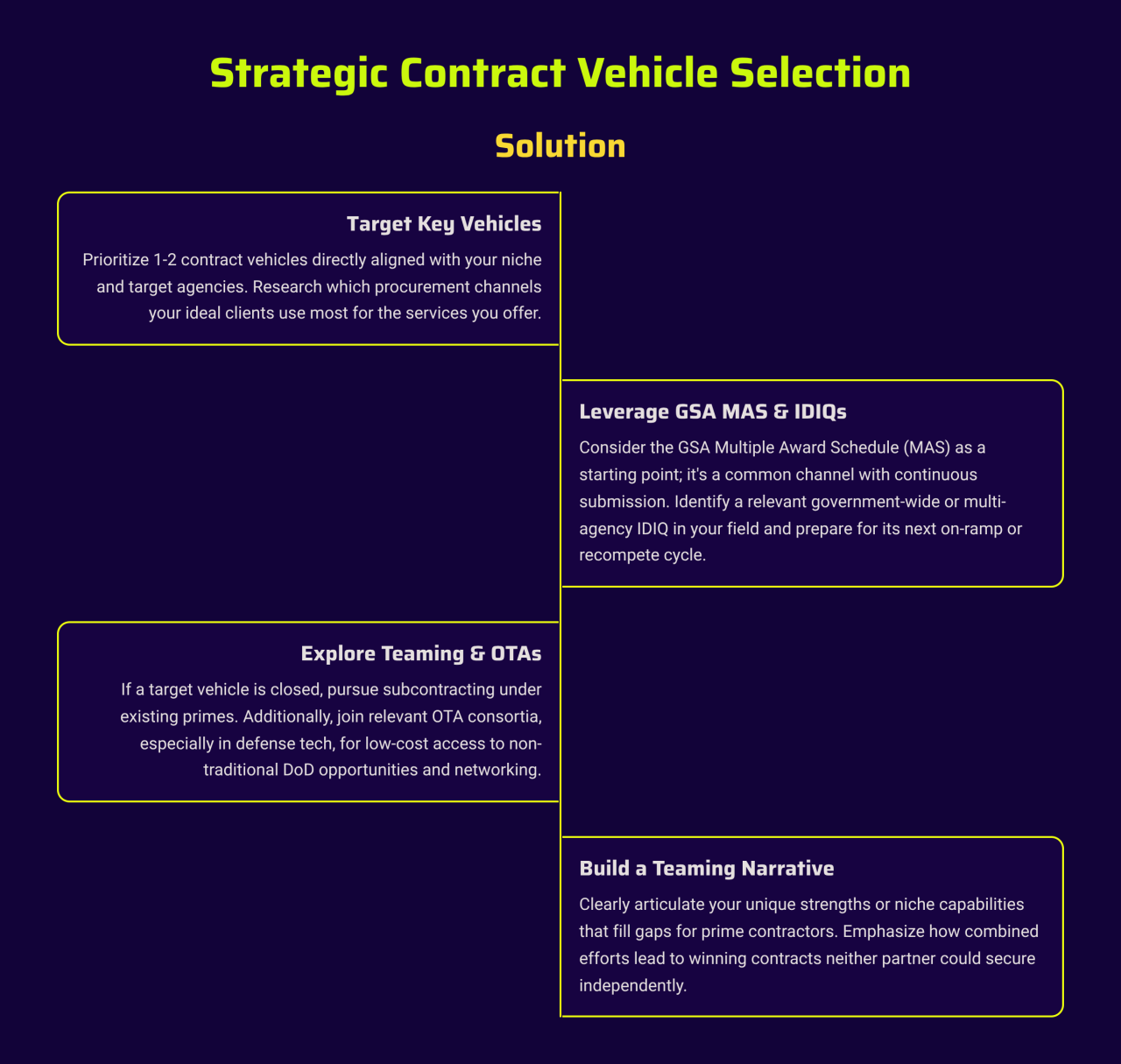

5. Access to Contract Vehicles

Problem: Not being on major contract vehicles can severely limit a new contractor’s deal flow.

Many federal procurements especially larger or recurring ones happen through GWACs, IDIQs, and multiple-award contracts (e.g. GSA MAS, NASA SEWP, DHS FirstSource, etc.), not open market bids.

If you have no GSA Schedule or IDIQ memberships, you simply won’t even see a huge portion of opportunities. Without a vehicle, you’re stuck chasing the scraps on SAM.gov, which are often highly competitive or small.

Additionally, not belonging to relevant OTA consortia (Other Transaction Authority groups) can mean missing out on prototype projects in defense.

In short, lacking contract vehicle access translates to limited visibility and fewer bidding chances.

Solution: Strategically target 1–2 contract vehicles aligned to your niche and join teams for others.

Don’t attempt to pursue every vehicle (that would spread you too thin). Instead, research which vehicles your target agencies use most for the services you offer.

For many, a good starting point is the GSA Multiple Award Schedule (MAS) – it’s the most common procurement channel and opens the door to significant annual spending.

If it fits, work on getting onto GSA Schedule (the nice part: you can submit an offer to MAS at any time, unlike some IDIQs that have narrow open seasons).

In parallel, look at one governmentwide or multi-agency IDIQ in your field (e.g. an IT contractor might target NIH CIO-SP or GSA Polaris).

Mark the next on-ramp or recompetition date and prepare to bid. If a vehicle is currently closed, use a teaming approach: subcontract under existing primes who hold that IDIQ.

Also consider joining relevant OTA consortia in defense tech areas – membership is often low cost and allows you to bid on OTA solicitations.

Joining a consortium can be an ideal way for a small business to “get its feet wet” with DoD prototypes, because it shows you have a collaborative network and can access non-traditional opportunities.

Meanwhile, build a teaming narrative that fills prime contractors’ gaps.

In practice, this means clearly articulating what unique strength or niche capability you offer that a larger prime might lack (e.g. a special skill, patent, or set-aside status).

Highlight how teaming with you helps “combine strengths [and] fill gaps” to pursue contracts neither of you could win alone.

By focusing on a couple of high-value vehicles and leveraging partnerships for others, you ensure you’re not cut out of the real action.

Over time, as you secure a vehicle spot and cultivate teaming relationships, your pipeline will diversify beyond the open-market bids on SAM.gov.

Remember: quality of pipeline matters more than quantity – better to have a 3x weighted pipeline of well-qualified leads than chasing every solicitation blindly.

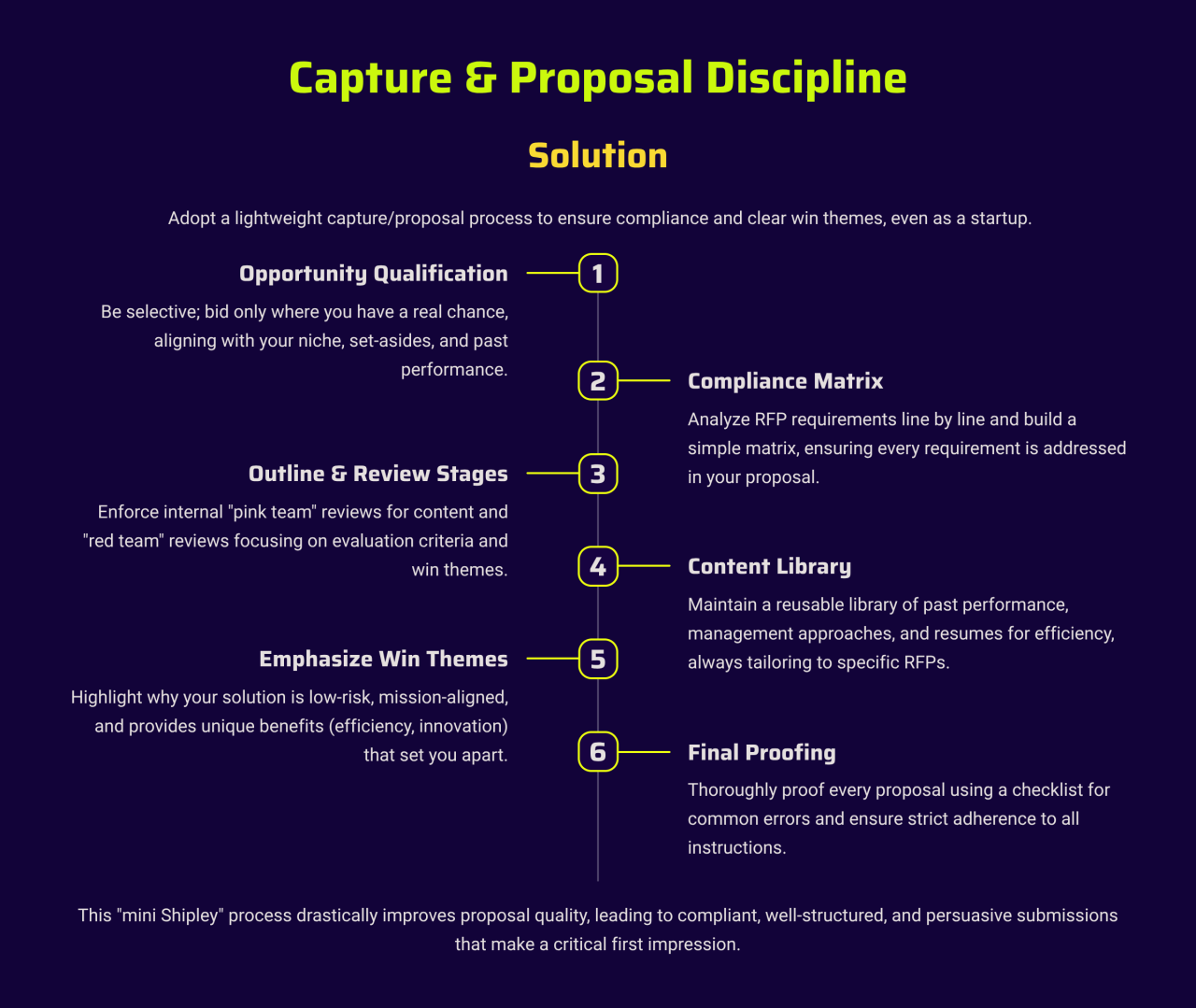

6. Capture & Proposal Discipline

Problem: Rushing into proposals ad-hoc – without a capture plan or compliance checks leads to missed requirements and weak “win themes.”

New contractors often chase many bids but treat each one as a fire drill, resulting in proposals that miss formatting or content instructions and fail to persuade.

A single overlooked requirement can “disqualify your proposal before it’s even reviewed.”

For example, using a generic past proposal as a template and not tailoring it will be obvious to evaluators and score low.

Likewise, without a compliance matrix or peer reviews, it’s easy to leave an RFP question unanswered or exceed page limits fatal mistakes.

In short, lack of a Shipley-style process (capture, pink team, red team, etc.) means proposals that are non-compliant and uncompetitive.

Solution: Adopt a lightweight capture/proposal process to ensure compliance and clear win themes.

You don’t need a massive proposal department as a startup, but you do need basic discipline.

Start with opportunity qualification be selective and bid where you have a real chance (e.g. within your niche, you meet the set-aside or past performance needs).

Once you commit to an RFP, analyze the requirements line by line and build a simple compliance matrix.

This matrix lists every RFP requirement and where in your proposal you address it, ensuring nothing is overlooked.

Top-performing teams “don’t leave compliance to chance” – a matrix is your checklist so that even a single buried requirement gets covered.

Next, enforce outline and review stages: do an initial content draft (perhaps a “pink team” review internally to check if your solution makes sense), then a red team review focusing on evaluation criteria and win themes.

During these reviews, have someone not involved in writing verify the proposal against the compliance matrix (are all sections present and in order?). This catches errors early. Maintain a reusable content library for efficiency e.g. past performance writeups, management approach narratives, resumes of key staff so you aren’t writing from scratch every time.

A well-organized content library offers a strategic advantage by speeding up proposal development while ensuring consistency.

However, always tailor and customize reused text to the specific agency and RFP evaluators can spot boilerplate easily.

As you write, emphasize win themes: why your solution is low-risk, how it aligns with the agency’s mission, and the benefits (better efficiency, compliance, innovation, etc.) that set you apart.

Finally, proof every proposal for compliance use a checklist for common errors (file formats, font size, SF33 signed, etc.) and ensure you followed every instruction (missing a minor formatting detail can signal carelessness).

By instituting this “mini Shipley” process, even a small company can drastically improve proposal quality.

You’ll submit proposals that are fully compliant, well-structured for evaluators, and persuasive which is critical, because a compliant, compelling proposal is often the only impression you get to make on a source selection board.

7. Pipeline Focus & Market Intel

Problem: Chasing every opportunity on SAM.gov is a recipe for wasted time and burnout.

New contractors sometimes subscribe to every FedBizOpps notice and cast a wide net, thinking it maximizes chances.

In reality, this lack of focus means you spend resources bidding on poor-fit contracts or learning new agencies “on the fly.” It’s far more effective to concentrate on a few target agencies or domains, but many newcomers struggle to narrow their focus.

Additionally, some don’t proactively gather market intelligence (like agency procurement forecasts or engagement with small business offices), instead reacting only to published solicitations.

Without a prioritized pipeline and decision stage gates (bid/no-bid criteria), you risk writing lots of proposals with low win probability.

Put simply: chasing everything means winning almost nothing.

Solution: Focus your business development on 2–3 target agencies (or mission areas), and build a structured pipeline with intel and gate reviews.

Identify which agencies best match your offerings (consider where your past contacts or your mission expertise align).

For example, if you have cybersecurity skills, you might target DHS and Air Force rather than randomly bidding at USDA.

Concentrate on those agencies learn their missions, follow their procurement forecasts, attend their industry days, and get to know their OSDBU (Office of Small & Disadvantaged Business Utilization) representatives.

Many agencies publish a Forecast of Contract Opportunities to help vendors plan ahead.

Use these to proactively position yourself for upcoming bids.

Also participate in any agency small biz outreach events or matchmaking; agencies often hold regular briefings or industry days to share their needs being present puts you on their radar. Meanwhile, maintain a “3× pipeline” of opportunities – meaning the total value of opportunities in your active pipeline is about 3 times your revenue goal.

More important than the ratio is implementing stage gates in your pipeline process.

This means for each opportunity you pass through stages: e.g. Qualification (does it fit our core, can we meet the requirements?), Pursuit (gather intel, partner if needed), Proposal (go/no-go based on final RFP and competition), etc.

At each stage, have “kill criteria” – hard questions that if answered unfavorably, you kill the pursuit early rather than waste a proposal effort. For instance, a kill criterion might be “we have no past performance in this exact area and no teammate to cover it.”

If true, you might decide not to bid. This disciplined approach prevents the scenario of chasing everything.

Additionally, invest in market research tools (many small contractors use free sources like spending databases and agency reading rooms, and some invest in subscription services) to gather intel on contract incumbents, agency spending patterns, etc.

And engage agency small biz specialists they can provide valuable guidance on where to focus and upcoming initiatives.

By picking a focused market segment and deeply engaging it, you’ll write far fewer proposals but with a much higher chance of success.

Your pipeline will be robust with well-qualified leads (aim for a mix of short-term and long-term opportunities to keep a healthy flow).

In summary: quality over quantity – don’t be the newbie that “responds to every RFP.” Instead, become known in your chosen agencies, and maintain a pipeline that is three times your goal value with each opportunity thoroughly vetted.

This will dramatically improve your win rate and conserve precious bid resources.

8. Cash Flow & Invoicing Delays

Problem: Slow payments on government contracts can strain a new firm’s cash flow.

Even though federal contracts are generally reliable payers, the timeline (often NET 30 days or more from invoice approval) means you might wait weeks or months to get paid, while payroll and vendor bills don’t wait.

DoD contractors must navigate invoicing systems like WAWF/iRAPT and others use the IPP for civilian agencies these can be complex, and any errors in the invoice can cause further delay. Small businesses frequently face a “pay gap” where they have to float costs (labor, materials) for a period.

Recognizing this, the government has a policy to provide accelerated payments to small business primes, with a goal of 15 days after a proper invoice but this is a goal, not a guarantee.

In practice, late payments or bureaucratic delays (especially if a contract mod or funding action is needed) still occur.

Without a line of credit or cushion, such delays can jeopardize your ability to make payroll.

Additionally, new contractors may not invoice optimally if you don’t include all required data (correct CLIN/SLIN, deliverable info, etc.), the payment office can reject the invoice, resetting the clock. Days Sales Outstanding (DSO) can easily stretch to 60+ days for new contractors, causing working capital stress.

Solution: Secure financial backing and enforce disciplined invoicing to bridge the payment gap.

First, arrange a line of credit or financing facility before you need it. Access to a line of credit provides a vital safety net during cash shortfalls you can draw funds to cover payroll when an invoice is slow, then repay when the government pays you.

Many banks offer SBA-backed lines or there are specialty lenders for government receivables (even invoice factoring is an option).

Next, whenever possible, negotiate favorable payment terms in your contracts. If the contract size and type allow, request progress payments or milestone payments on long projects.

For example, on a services contract, propose billing monthly for work performed (standard) but if it’s a big job with ramp-up costs, maybe negotiate an initial partial payment at kickoff or acceptance of a first deliverable.

Some agencies will agree to milestone billing which provides earlier cash inflow.

Third, invoice promptly and correctly. The moment you’re allowed to invoice (e.g. at month-end or upon deliverable acceptance), submit it immediately even a few days of delay are unnecessary.

Ensure your invoices are 100% accurate and include all required backup and coding.

A timely and accurate invoice speeds up payment and avoids disputes. Use the government’s invoice checklist: include the contract number, CLIN references, date range of services, and attach any required reports. This reduces the chance of rejection.

Also, actively track your DSO – measure how long each invoice takes to get paid, and if any go past due, follow up through the payment office or contracting officer.

Don’t be shy about politely inquiring on status if a payment is late sometimes an administrative holdup can be cleared by communicating.

Internally, monitor cash flow forecasts religiously.

Anticipate periods where multiple project expenses coincide before payments arrive. Adjust spending or seek advance funding accordingly.

In short, you need to act as your own CFO: plan for worst-case payment timing, have credit available, and keep a tight invoicing regimen.

Over time, as you build history, you may benefit from accelerated payment policies, but always have a backup plan.

By doing all this, you’ll avoid the classic fate of winning work but going broke waiting to get paid.

Strong cash flow management ensures you can execute contracts smoothly and take on new ones confidently.

9. Talent & Clearances

Problem: Recruiting and retaining qualified, cleared talent is particularly challenging for small contractors.

Many federal contracts, especially in defense/intel, require personnel with active security clearances and very specific labor category qualifications (degrees, certifications, years of experience).

As a new entrant, you likely don’t have a bench of cleared employees ready to deploy, and you’re competing with larger firms that offer high salaries and established benefit packages.

You might win a contract but then struggle to hire the cleared staff to perform it or lose key people to bigger competitors mid-contract.

Additionally, proposal requirements often mandate resumes for Key Personnel or proof that candidates meet labor category criteria.

preparation, a new contractor could fail to staff up on time or propose unqualified personnel.

It’s also tough to afford sponsoring clearance investigations as a small business, and if you lack an FCL (Facility Clearance), cleared candidates might be wary. All combined, talent acquisition (especially cleared talent) can be a make-or-break hurdle for fulfilling contracts.

Solution: Proactively build a talent pipeline and offer competitive conditions from day one.

Start by lining up contingent hires during the proposal phase.

When bidding on a contract, identify the key roles you’ll need and recruit conditional candidates for them obtain contingent offer letters or letters of intent that say the person will join you if you win. Companies do this routinely to “demonstrate their ability to staff the contract” and boost proposal credibility.

It shows evaluators you have a ready workforce.

Use networks and online cleared job boards to find these candidates (perhaps those on similar expiring contracts).

Ensure their resumes exactly meet the labor category requirements; explicitly map their years of experience and credentials to what the RFP calls for (document this in proposals so evaluators see the compliance).

Second, even before you have a contract, consider maintaining a “bench” of cleared consultants – maybe a few part-timers or subcontractor relationships – who can be quickly brought on if you win work. This is essentially a talent pool you keep warm.

Engage with staffing firms specializing in cleared placements to help fill surge needs quickly.

Third, invest in your HR and benefits to attract and keep talent.

As a small business, you may not match a Lockheed Martin on brand name, but you can compete by offering a good benefits package and work environment.

Competitive pay is a given, but also provide things like subsidized health insurance, retirement plans, and flexible work arrangements.

In fact, attractive contractor benefits beyond just salary (e.g. strong health coverage, generous PTO, training allowances, maybe partial remote work) are key to retaining cleared employees in a competitive market.

It’s noted that retaining talent in GovCon requires a strategy with “attractive benefits” tailored to what employees value.

Even if it pinches your margins initially, building a reputation as a great employer will save money in the long run through lower turnover.

Also, ensure you have the basics: e.g. if you have employees in the DC area, provide a smooth process for clearance sponsorship and reinvestigations, and consider paying for certifications or education – cleared folks often jump for better growth opportunities, not just pay.

Finally, plan for contingencies: if key staff leave, have back-up candidates or a cross-training plan so you’re not caught short (some contracts allow a 30-day window to replace a departing key person before it’s a performance issue use that time by having options ready).

In proposals, you can even mention your employee retention strategy to alleviate government concerns (for instance, highlight that you offer above-industry benefits or that your leadership includes veterans who understand cleared workforce needs).

By treating talent as a core asset recruiting early, taking care of employees, and mapping their qualifications to contract needs a small business can punch above its weight. You’ll fulfill contracts with a stable, qualified team and avoid the nightmare of scrambling for personnel after award.

10. Differentiation & Digital Presence

Problem: A generic brand image and weak digital presence can make a new contractor effectively invisible to both government evaluators and teaming partners.

In the federal market, decision-makers do check your website, capability statement, and online footprint to size you up.

If your website is a templated, one-size-fits-all page (like a bare-bones GoDaddy or Wix site) with buzzwords but no substance, you blend into the noise.

In Northern Virginia especially, *“everyone has past performance, everyone has cleared staff… The difference between being ignored and being noticed comes down to digital clarity and positioning.”

Many small contractors don’t bother to create niche landing pages or tailor their messaging – e.g. they list generic services (“IT, consulting, staffing”) without showing understanding of specific agency missions.

Contracting officers or primes who land on such a site won’t be impressed or may not understand what you actually do.

Likewise, a weak or cluttered capability statement (or none at all) fails to convey your value succinctly.

Another pitfall is neglecting SEO/AEO if your content isn’t structured for search engines or AI “answer engines,” you might not show up when agencies search for solutions.

Using cookie-cutter website builders can exacerbate this, as some have limitations in deep SEO customization.

Overall, poor digital presence = lost credibility and missed opportunities, whereas a sharp, mission-focused digital footprint can be a secret weapon.

Solution: Build a mission-focused digital footprint from the start professional website, micro-niche content, strong capability docs and avoid one-size-fits-all site builders if they limit you.

Begin with your website: design it to immediately communicate your core competencies and differentiators.

It shouldn’t take four clicks to figure out what you do – make it clear on the homepage.

Develop dedicated landing pages for each target agency or market niche you serve.

For example, have one page speaking directly to “Solutions for DHS Homeland Security,” another for “Defense Health IT,” etc., with language and proof points relevant to those customers.

If your site doesn’t have tailored landing pages for each audience, you blend into the noise.

These micro-niche pages signal that you understand specific missions and have specialized capabilities.

Next, craft a compelling one-page capability statement (a PDF handout) that crisply summarizes your company info, core offerings, past performance highlights, differentiators (e.g. clearances, certs), and contact info.

This is your calling card – make it visually clean and easy to read in a few minutes.

Many agencies and primes request or download these, so ensure yours stands out (no fluff, just facts and value).

On your website, incorporate past performance snippets and compliance badges – e.g. mention “Trusted on 5 projects for Army PEO EIS” or display any ISO, CMMI, or socio-economic certifications you have.

These build credibility. Critically, optimize your online content for search/visibility this goes beyond basic SEO into what’s now called Answer Engine Optimization (AEO).

That means structuring your website with FAQ sections, schema markup, and clear, concise answers to common questions, so that modern search engines (and AI assistants like Bing’s AI or Google’s featured snippets) can readily present your info.

For instance, include a Q&A on “What is [YourCompany]’s experience in XYZ?” or “Does [YourCompany] meet NIST 800-171 requirements?” answering these on your site (with proper HTML schema) can boost your credibility when evaluators search those queries.

Ensure your site is fast, mobile-friendly, and 508-accessible (for bonus points, since agencies value accessibility).

When it comes to website platform – while builders like Wix or GoDaddy can get you online quickly, they often trade flexibility for convenience.

Templates can be limiting in design and in adding custom code or integrations.

Given the importance of structured content and unique branding, you may be better off with a more customizable platform (e.g. WordPress with a good theme) or hiring a web designer who knows the GovCon space.

The goal is a site that looks and reads like a serious federal partner instilling instant trust.

In Northern Virginia’s cutthroat market, a polished, mission-focused website can make you “easier to find, easier to trust, and easier to remember,” directly contributing to contract wins.

So don’t skimp on digital presence: publish those niche pages, keep content updated (e.g. news of contract wins or new certifications), and portray a consistent message across web and print.

This way, when an evaluator or teaming prime checks you out, they encounter a company that appears clear, specialized, and ready not a forgettable generic small business.

Quick Startup Checklist (Days 30–60–90):

To put all this together, here’s a timeline for the first 3 months:

- By Day 30: Complete all registrations – SAM.gov (with UEI and CAGE in hand, reps & certs loaded) and SBA profile. Implement basic cyber hygiene controls (MFA on accounts, antivirus, backups). Finish your one-page capability statement. Launch a simple but professional website with at least 2 niche landing pages targeting your primary agencies.

- By Day 60: Join or form teams for one target contract vehicle (e.g. get your GSA Schedule offer in, or become a confirmed subcontractor on a large IDIQ). Establish your internal accounting policies and job-cost system; get a DCAA checklist and ensure you tick those boxes (timekeeping, cost segregation). Build a modest proposal content library – gather past project write-ups, management templates, and resume formats so you can reuse them. Also, collect at least two reference outcomes from past work (even if commercial) that you can cite in proposals or on your site.

- By Day 90: Submit 2–3 fully compliant bids (quality over quantity – ensure they went through compliance and review). Refine your indirect rates and pricing models based on any feedback or actuals from early projects. Expand your website’s AEO/FAQ content – add Q&As or blog snippets that address common GovCon evaluator questions, with schema for search. And formalize a capture/proposal “cadence” – e.g. a weekly pipeline review, bi-weekly strategy sessions for upcoming bids, etc., to enforce the discipline going forward.

Northern Virginia is the most competitive GovCon arena in the country and that’s your unfair advantage if you execute with clarity.

Winners here don’t look bigger; they look easier to trust.

That means a mission-focused website (not a generic GoDaddy/Wix template), micro-niche landing pages for each target agency, evaluator-ready capability documents, and AEO so contracting officers actually find and understand you in seconds.

Do this and the “top 10” startup hurdles become a checklist you run—not walls you hit.

Your next moves (start today):

- Ship a clean, mission-aligned homepage and 2 micro-niche landing pages (one per highest-priority agency).

- Publish a sharp, 508-ready capability statement that matches the landing page claims.

- Add FAQ + schema for AEO and wire up analytics to track opens, time on page, and meeting requests.

- Lock a 30-60-90 cadence: registrations complete, first teaming commitments, compliant proposals in the queue.

If you’re serious about winning in NOVA, commit to launching your first two landing pages and a refreshed capability statement this month.

Need a starting point?

Say the word and I’ll draft a one-page site outline, two niche page wireframes, and a capability statement structure you can drop into your build.

References (APA)

- Defense Contract Audit Agency. (n.d.). Preaward survey of prospective contractor accounting system (SF 1408) and accounting system adequacy guidance.

- Federal Acquisition Regulation. (n.d.). FAR part 31—Contract cost principles and procedures; FAR 32—Contract financing; FAR 52.204-21—Basic safeguarding of covered contractor information systems.

- General Services Administration. (n.d.). Multiple Award Schedule (MAS) program overview and vendor guidance.

- National Institute of Standards and Technology. (2021). Protecting controlled unclassified information in nonfederal systems and organizations (NIST SP 800-171 Rev. 2). Gaithersburg, MD: U.S. Department of Commerce.

- Office of the Under Secretary of Defense for Acquisition & Sustainment. (2023). Cybersecurity Maturity Model Certification (CMMC) 2.0 program overview.

- Shipley Associates. (2019). Proposal guide: Best practices for proposal development (5th ed.).

- Small Business Administration. (n.d.). Dynamic Small Business Search (DSBS) and federal contracting programs.

- U.S. Department of Defense. (n.d.). DFARS 252.204-7012—Safeguarding covered defense information and cyber incident reporting.

- U.S. Department of the Treasury & Defense Finance and Accounting Service. (n.d.). Invoice submission and processing (IPP, WAWF/iRAPT) guidance for federal contractors.

- Various federal agency OSDBU offices. (n.d.). Forecasts of contract opportunities and small business engagement resources.